I’m thinking back to the time when I bought my first piece of music gear on eBay in 2001. It was a Yamaha TX81Z FM rack synth module, fairly beat up. It had a lot of cheesy, useless-sounding patches and a few really nice ones. I had a Yamaha DJX keyboard that my mom had bought me the previous Christmas. Together, with those two pieces of gear, I wrote Forest of Worlds at the house at 4026 Westway in Toledo. I didn’t have much other gear, just a bass guitar (I think it was an Ibanez Ergodyne EDC705, but it might have been something else) and an electric guitar, a modified Peavey Predator with a multi-effect pedal. There was really nothing I couldn’t do with that gear given enough talent/skill. Which I didn’t have yet.

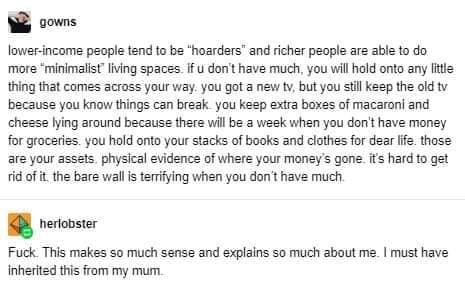

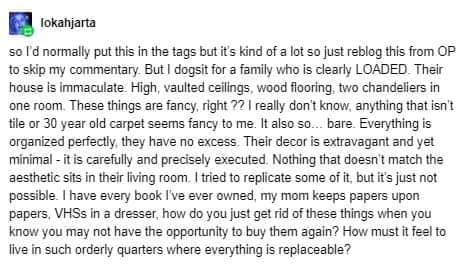

Before Forest of Worlds, I had never written any music using the keyboard. Sure, there was a track where the DJX was playing drum sounds on my first album, but that wasn’t keyboard music. Before that, I had only written tracker, fractal, and guitar tunes. While it opened a whole new world of synthesizer music and spawned some beautiful-to-me songs like Trepidation, Encounters, Gliding, Cosmic Serenade, Quelet, Montagne, and others (in spite of the core of Bloodless Mushroom being a mix of fractal and tracker tunes), it also created a monster. From that moment on I started hoarding gear, collecting things less because they served a useful purpose and more because I could. I wanted to have every possible sound at my fingertips. I wanted to experience and explore everything out there in the world. And I pretty much did.

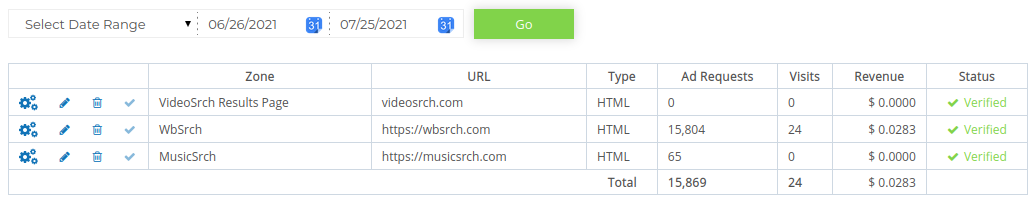

While the time spent playing and practicing made me a better musician, the gear hoarding did not. In fact, it actively detracted from my musicianship. I spent too much time fiddling with gear, noodling, and just shuffling things around, and not enough time practicing and writing music. I did create the SoundProgramming website from my explorations, which has helped a lot of people explore gear and get manuals for it, so it wasn’t all wasted effort.

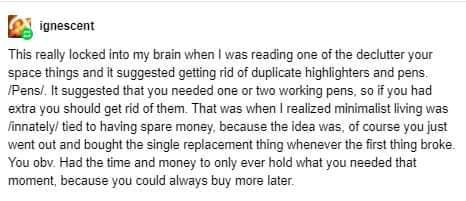

Now I have every sound imaginable at my fingertips. I have so much software and so many libraries that there’s nothing I can’t do electronically (my sample library is more than 600 gigabytes). Since Bloodless Mushroom was always more of a tracker-and-fractal project, I never needed anything more than a laptop to write music in the first place. I certainly don’t need a whole room full of gear. In fact, the more in-the-box I work, the more creative I seem to be.

Just give me a keyboard (with MIDI). Practically any keyboard will do, but full-size keys help. Just give me a bass guitar and regular guitar and a cord to connect them with. The make and model doesn’t even matter, as long as they stay in tune. I do not need more gear than I can carry on my back. Well, as long as I’m not playing/writing drums. A real electronic or physical kit won’t fit on my back.

Proof of this just-plug-something-in-and-go is in the Rain Without End songs. They’re really just me multitracking guitar and bass. And it sounds good. Not perfect by any means, but I can put together nice-sounding ideas that people enjoy.

I must confess that using three GM-capable synths like I did for the Gymnopus album sure does sound good, though. All that can be achieved in software like Kontakt, of course. It just requires more detail work. If I do that work, the quality will be far beyond anything I could get with a 17-year-old hardware module.

What I’m trying to say is this: I don’t need to take any of this stuff with me. I can get what I need wherever I am, and I don’t need much.